State-by-state wins in legalizing marijuana haven’t yet translated into large stock-price gains for U.S. cannabis companies, but that may be about to change.

The U.S. cannabis market reached some major milestones in the last few months, with gains that stretched both geographically and politically from New York to South Dakota. Even where there have been hiccups — for example, Mississippi, where voters overwhelmingly approved a medical marijuana plan last year that’s now facing legal hurdles — there would seem to be no reversing this tide. Ticking the state-by-state wins hasn’t yet translated into large stock-price gains for U.S. companies, but that may be about to change.

Recent incremental progress on the cannabis front points to a larger moment on the horizon: a comprehensive marijuana reform bill. It’s an effort led by Democrat Senators Chuck Schumer, Ron Wyden and Cory Booker. Lest this be considered a partisan endeavor, though, Americans for Prosperity — a conservative political advocacy group founded by the Koch brothers — notably just endorsed the legalization of marijuana. Plus, 91% of Americans say pot should be legal in some form, including large numbers of Republicans, according to Pew Research Center.

The relaxation of federal laws would give U.S. cannabis companies the chance to attract the investor money that Canadian growers have amassed in recent years and allow the industry to flourish in ways it can’t right now. It starts with the SAFE Banking Act, a bill that passed last week in the House of Representatives with bipartisan support. The Senate is unlikely to take it up for a vote, but don’t think of that as a setback. It’s actually careful policy planning by Democrats that don’t want to see America’s grand opening of Marijuana Inc. become yet another case of worsening economic inequalities.

To understand, it’s important to first be aware of the peculiarities of investing in cannabis companies: The biggest names that carry U.S. stock tickers are actually Canadian businesses — Aphria Inc., Canopy Growth Corp. and Tilray Inc., to name a few. Their American counterparts — such as Curaleaf Holdings Inc., Green Thumb Industries Inc. and Trulieve Cannabis Corp. — are relegated to less liquid Canadian exchanges or over-the-counter trading because pot is still illegal at the U.S. federal level and listing standards maintained by the New York Stock Exchange and Nasdaq prevent their inclusion on these platforms. This gives the Canadian operators a big advantage in capturing investors’ zeal for the lucrative growth opportunities afforded by pot, as evidenced by their steeper valuations:

Federal Discount

Canadian cannabis companies that trade on U.S. exchanges are valued at an average of 10 times sales, compared with 5 times for U.S. multistate operators.

The SAFE Banking Act would make it permissible for banks to do business with marijuana entities, which could also open the door to U.S. companies being able to list on U.S. stock exchanges. In turn, Canadian companies could make use of their relatively rich stock prices to acquire in the U.S., which has the larger consumer market. But Schumer told Marijuana Moment last week that he doesn’t want small businesses and minority-owned businesses to be left out as pot spurs a new class of millionaires and billionaires:

We want to make sure that there are reinvestment initiatives and it doesn’t all go to the big shots … that this just doesn’t let all the bankers, the big boys, in without taking into account that communities of color have paid the greatest price here and should get some recompense.

Instead of passing SAFE in a vacuum, it’s more likely that key parts end up in the “bill of bills” encompassing broader cannabis reform that Schumer is helping to draft, which could help it win Republicans’ support, Pablo Zuanic, an analyst for Cantor Fitzgerald, wrote in a note to clients. The plan could also include measures to expunge low-level marijuana infractions from people's records and reinvest marijuana tax money back into communities of need.

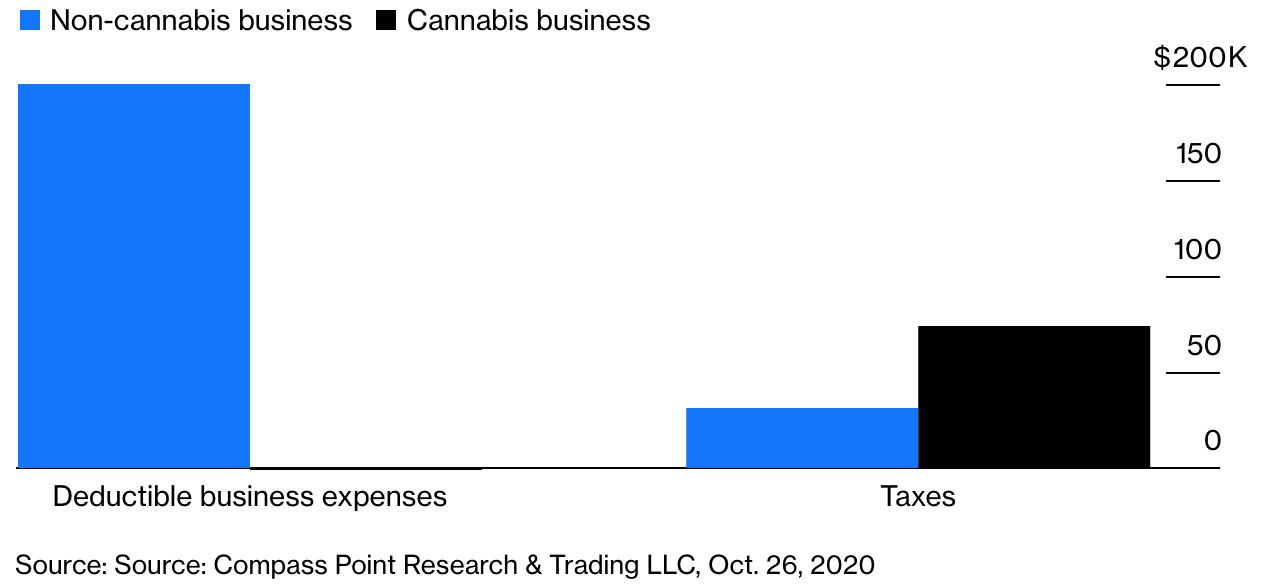

Another vital provision would be to reclassify cannabis in the Controlled Substances Act, where it’s a Schedule 1 drug, the most serious class, alongside heroin. In October, Compass Point Research & Trading analysts demonstrated how meaningful de-scheduling cannabis could be for pot companies’ bottom lines, given that they’re currently forbidden from deducting certain business expenses for tax purposes:

Business Case for De-Scheduling Pot

A non-cannabis business and a cannabis business each with $1 million in sales and $350,000 in gross income would have very different tax bills:

Lifting those profit barriers and easing the way for U.S. public offerings would drive a flood of investment, including by creating a linkage to institutional investors. But rather than run with a banking-focused bill, the payoffs will be greatest with reform that takes a broader and more equitable approach. It just takes more time.