For entertainment and media companies around the world, the past 18 months have been a period of remarkable uncertainty and challenge. The well-known forces that were changing our world—digitization, globalization, disruption, shifting consumer habits and demographics—were amplified by a powerful new one, the first global pandemic in a century.

Navigating a world of asymmetries

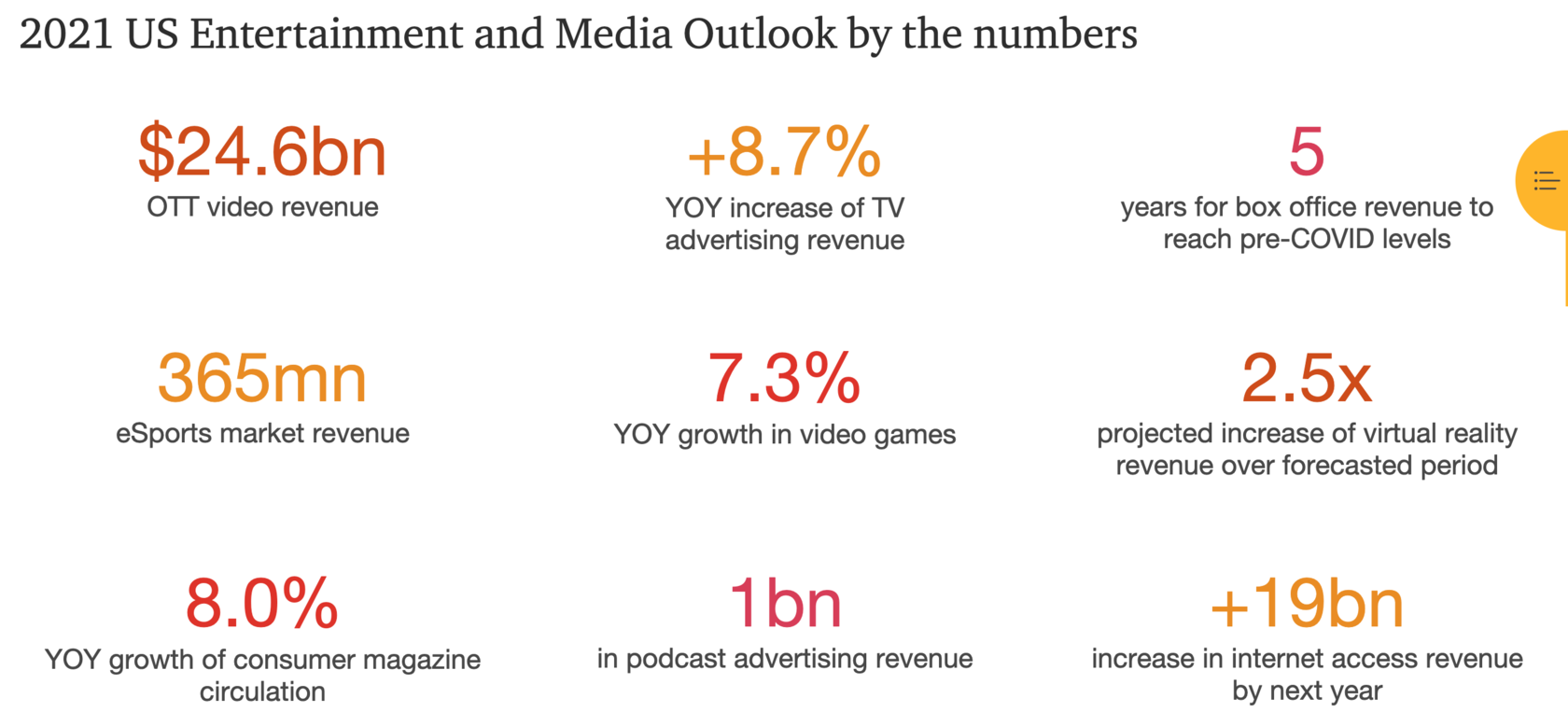

Amid the sobering reality that the world will continue to struggle to bring COVID-19 under control, what had been a widely shared global experience is now diverging between different territories and industries. A global recession, the first since 2009 and only the second since 1944, is being followed by a rapid but highly asymmetrical snap back, fuelled by scientific innovation and forceful government policies. The vast US$2tn entertainment and media (E&M) industry contains some sectors that were among the most heavily affected by shutdowns and others that were among the chief beneficiaries of shifts in behavior. Accordingly, 2020 was a year of immense and dramatic power shifts in the vast, interconnected E&M industry, which garners a growing share of the world’s attention and wallet with each passing year.

Altering the dynamics as a new equation emerges

The shifts are grounded in changes in consumer behavior that appeared as a result of the pandemic, some of which will endure and accelerate. Overlaid on these shifts, continuing advances in technology and in the delivery and distribution of content are creating new tensions and altering the complex dynamics and relationships between consumers and providers, between creators and producers, between producers and distributors, between advertisers and publishers, between governments and companies, between the giant global platforms and everybody else.

These power shifts are impelling changes in industry business models and in the relative strength of participants, altering the way that profits are created and providing the impetus for transactions small and large. As a new equation emerges for creating value, sustaining outcomes and building trust, a deep understanding of the data, trends, technologies and behaviors is needed to shed light on the path forward.

Common threads

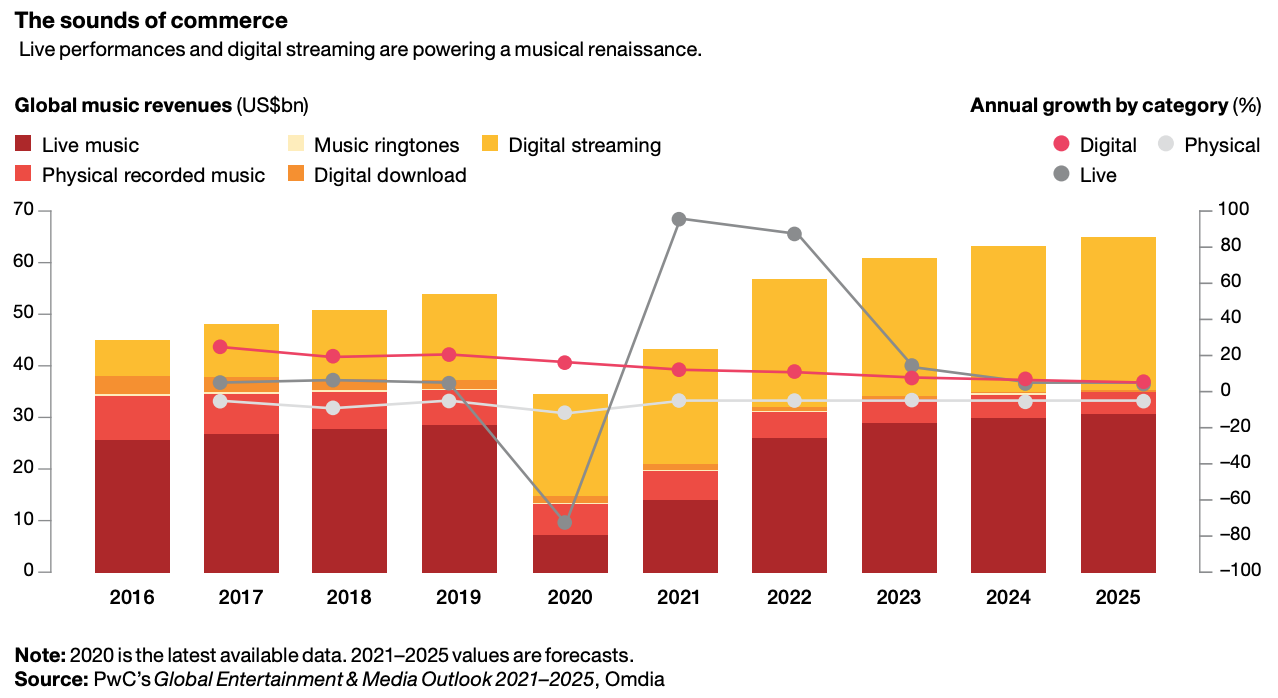

There are some common threads amid these power shifts. First, it’s vital to meet consumers where they are now and where they will be in the future. Increasingly, that means online, on mobile devices, at home, and at the time and place of their own choosing. Second, because we live in an age of near-constant discontinuities, we can’t assume that existing trends will continue indefinitely into the future. The music industry, which many analysts believed had been left behind by the digital era, is enjoying a renaissance, spurred by strong growth in digital streaming and a strong rebound in live performances. Internet advertising, thought to be entering a period of slower growth, has been buoyed by the rapid global adoption of e-commerce. And although the largest platforms have enjoyed a spectacular run of growth off ever-larger bases, the forces of regulation appear to be awakening.

These disjunctions and shifts, which create risk and open up new vistas, are precisely what makes these industries so fascinating to follow. And they make it even more important to understand, at a granular level, just how these dynamics are playing out in different territories and sectors.

Macro shifts: Powered by disruption

The most obvious—and most global—of the drivers of change in E&M is the migration to digital consumption. As consumers stayed home and in-person venues shut down, the use of in-home digital services soared. Movie theatre boxoffice revenues fell 71% in 2020, even as Netflix attracted a record 37mn net additional subscribers, pushing its subscriber rolls past 200mn. Historically, rising digitisation was a challenge, as analogue dollars were frequently replaced by digital dimes. But in 2020, consumers’ embrace of all things digital helped offset sharp revenue losses across the broader global E&M sector.

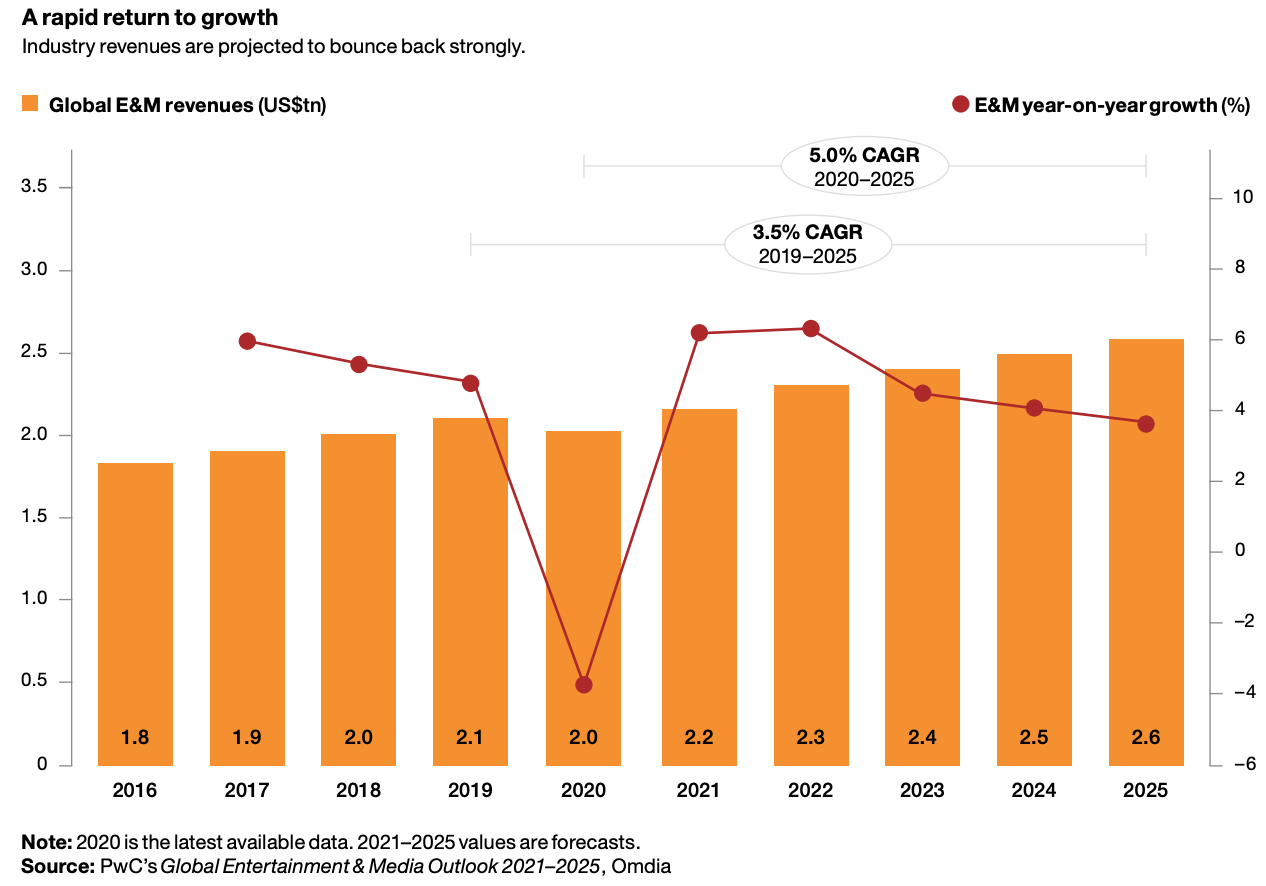

Growth is the global E&M baseline

Over the coming five years, growth in E&M revenues will be the norm across all 53 territories we cover. No country’s combined consumer and advertising revenue will rise at less than a 3.0% five-year CAGR to 2025, with Japan the lowest at 3.1% (see chart on page 5). By contrast, in the 2019 version of this analysis, 26 countries dipped below a 3.0% five-year CAGR, including almost all of Western Europe. India, where consumer and advertising revenue fell just 0.2% in 2020, has the highest growth forecast to 2025, at a 10.4% CAGR. Despite the challenges it faces with COVID-19, India—which should surpass China in 2022 to become the world’s most populous country—has immense potential for expansion (for more, see the PwC report Full potential revival and growth: Charting India’s medium-term journey). Other outliers include Saudi Arabia, whose market has been strengthened greatly by the lifting of a 35-year ban on cinemas in 2018, and Nigeria, where booming video games and TV subscription revenue will push the five-year CAGR to more than 10%.

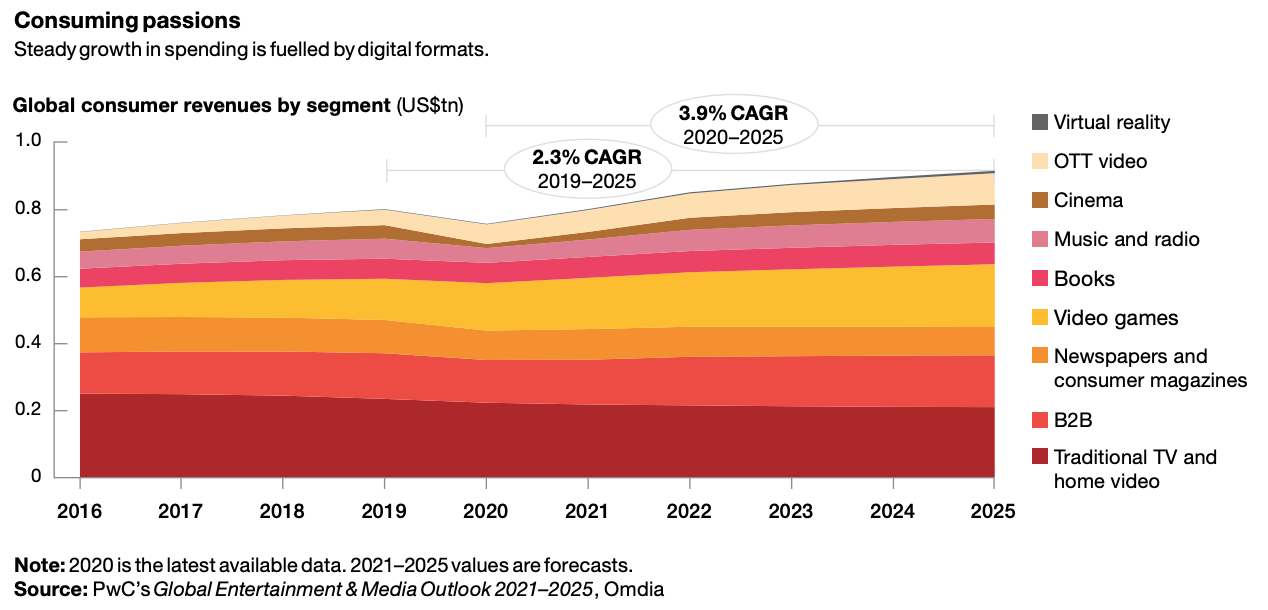

Sector shifts: Access booms, ads hold firm, consumer spending recovers

One of the signal impacts of the pandemic was that more people spent more time at home and more time online. The rapid move to digital content services during the pandemic was part of a wider migration (see chart below). People streamed shows and read e-books instead of going to movie theatres and bookstores, pedaled along with Peloton instructors instead of going to SoulCycle studios, and formed digital communities on the audio app Clubhouse instead of attending debates. This shift fuelled e-commerce, which in turn attracted more advertising—even if consumer activity overall was muted. Cross-currents were evident in the three main sectors into which E&M spending is divided: access, consumer spending and advertising. As internet access and data became a lifeline and a form of utility, access was the only one of the three main sectors that rose in 2020, up US$14bn, or 2.1%, and accounting for 34.1% of all spending. Consumer spending shrank 5.5%, making up 37.1% of total spending, and advertising was stable, at 28.7%.

Connectivity comes to the fore

The shift towards online consumption spurred significant growth in businesses and products surrounding connectivity (see chart above). In total, 1.1bn households worldwide had fixed broadband in 2020, up 3.4% from 2019, with penetration reaching two-thirds for the first time. More than three-quarters of those connections are classified as high-speed—that is, 30Mbps and above. In 2020, there were 4.6bn smartphone connections, up 6.5% from 2019—that’s one for every 1.3 people on the planet—and the figure is projected to rise at a 4.0% CAGR through 2025. The combination of more devices, higher speeds and more activity fuelled remarkable growth in total data consumption, which rose 30% during the year and is projected to continue rising at a 26.9% CAGR through 2025. Revenue associated with all this data is projected to increase at a lower rate—underlining the fact that consumers are getting a lot more without having to pay a lot more. Indeed, the concept of a widespread premium going to consumers is a fundamental characteristic of our age.

Shoppers move online

One of the activities that people are carrying out on all these connected devices is shopping—acquiring goods and an expanding range of services, including entertainment and media. This holds true both in established markets and developing ones. In Brazil, as tens of millions of people began purchasing via the internet for the first time, e-commerce revenues grew 41% in 2020. And the March 2021 edition of PwC’s Global Consumer Insights Pulse Survey found that 29% of the 8,700 consumers surveyed in 22 territories expected to spend more on home entertainment—movies, video games, music and books—over the coming six months, against just 20% who thought they would be spending less.

Spending on E&M was subdued

However, with the economy contracting and shifts in competition and technology often exerting downward pressure on pricing for content and services, the growth in revenues from consumer spending was muted. In 2020, consumer spending on E&M fell 5.5%. By 2025, the total is projected to rise to US$914.9bn, representing a 3.9% CAGR from 2021, as the stagnation of legacy sectors such as newspapers and magazines is more than offset by rapid revenue growth from booming areas that cater particularly to younger consumers, such as video games and esports (CAGR of 5.7% to 2025) and OTT video (CAGR of 10.0% to 2025). That said, traditional TV and home video will continue to account for the largest share of total consumer revenue—even as that segment declines at 1.2% compounded annually through 2025. As more goods and services are sold online, advertising aimed at encouraging and influencing decisions migrates to these platforms. Internet advertising spending rose by US$28bn in 2020 to reach US$336bn, a 9% increase. Although slower than the 16% recorded in 2019, this still represents impressive growth off a continually rising base. With internet advertising set for a CAGR of 7.7% from 2020 to 2025, even as traditional components such as television stagnate or decline, overall advertising revenues are expected to rise from US$582.5bn in 2020 to US$797.8bn in 2025 (see chart above). Between 2020 and 2025, advertising’s share of overall E&M spending will increase by more than two percentage points. But in advertising, as in content, the rising tide of revenues will be distributed to different players and participants than in the past.

Generational shifts: Creators and youth will be served

2020 was a humbling year for some members of the E&M establishment. Quibi, the venture-backed shortform content start-up helmed by Hollywood veterans, found that its highly produced shows made with established stars flopped. A mere 10.4mn viewers tuned in to the Academy Awards; that’s a fraction of the 80mn followers that 20-year-old influencer Addison Rae has on TikTok. The reality is that younger consumers simply have little awareness of—or interest in— traditional media. On the flip side, the platforms that are targeted towards young people or that facilitate lightly produced authentic content boomed. This dichotomy was fuelled by twin ongoing power shifts: from older to younger consumers, who set the trends and increasingly dominate the conversation, and from producers to creators, who increasingly benefit from reward mechanisms for attracting eyeballs.

Creators are flocking to TikTok and Roblox

Nothing exemplifies this shift like the rise of ByteDance’s global short-form and self-generated video platform TikTok and its Chinese incarnation, Douyin. As of late 2020, TikTok and Douyin had built up—in just four years—a combined global base of more than 1.29bn monthly active users in 141 countries. That’s nearly one of every six people on Earth. In July 2020, at a TikTok Live event at Billboard Live Tokyo and Billboard Live Yokohama, more than 285,000 viewers logged in to the live stream to watch performances by Japanese pop artists including Novelbright and milet. Not surprisingly, commerce and ads are following all this attention. TikTok has a creator marketplace that helps brands in 40 countries find partners, and its Creator Fund enables people whose self-generated content makes waves on the platform to earn money from their posts.

Young creators are also at the core of the business model of Roblox, a gaming platform that enables users to build their own games and play games developed by others. Roblox, which is most popular among children, went public in a blockbuster IPO in March 2021 and boasts a market capitalisation of about US$55bn. In April, the company reported that 43mn active users spent a collective 3.2bn hours on the platform during the month—about 2.5 hours a day.

Musicians are seeking a bigger payback

Against the odds, and despite widespread predictions of doom, music has been one of the standout E&M performers in recent years, as streaming has finally gained critical mass (see chart on page 9). Revenues from live music slumped by 74.4% in 2020 and are expected to return to 2019 levels only in 2023. But between 2020 and 2025, the music sector as a whole is expected to grow at a 12.8% CAGR, fuelled by rapid growth in both live performances and digital streaming, which will be a US$29.3bn business in 2025.

The rapid growth in streaming has powered corresponding increases in the value of large catalogues of music and their associated rights. That’s good news for formerly embattled creators who aim to monetise their portfolios of work. Taylor Swift, after a long-running dispute with the company that owned rights to her master recordings, began re-recording and reissuing her previously recorded hit songs to regain ownership. Other major transactions included Paul Simon selling his catalogue to Sony for US$250mn, Stevie Nicks selling a majority stake for US$80mn to independent operator Primary Wave, and Bob Dylan selling his 600+ song catalogue to Universal for a reported US$300mn.

Non-fungible tokens Non-fungible tokens (NFTs) represent a notable innovation in the ability of creators to go directly to customers. NFTs are irreplicable blockchain-based tokens that effectively assign ownership, in some form, for a specific digital item. A robust market for NFTs has sprung up among collectors and speculators. Key milestones in the market’s development included the sale of a digital collage artwork by the artist Beeple for US$69mn and the sale of the first-ever tweet (by Twitter founder Jack Dorsey) for US$3mn. The NBA’s Top Shot Licensed Digital Collectibles NFTs launched in June 2020 and had traded over US$550mn for video “Moments” by May 2021. And although musicians may have missed out on live performances and the merchandise sales that go with them, Grimes sold thousands of NFTs at US$7,500 each for two short videos— the digital equivalent of signed, limited-edition prints. The Kings of Leon launched an album in March 2021 as an NFT that included a limited edition vinyl disc, along with MP3 files and a GIF of the artwork.

Business model shifts: The streaming wars

Changes in consumer behaviour have driven powerful shifts in E&M business models. Foremost among these shifts is the way the streaming boom of 2020 has set the industry on a new growth trajectory. Streaming video-ondemand (SVOD) revenues will grow at a 10.6% CAGR through 2025, by which point SVOD will be a US$81.3bn industry (see chart on page 12). But there is likely a limit to the number of streaming subscriptions a household is willing to buy—and people can cancel their OTT services with relative ease.

Also, the expanding array of global streaming services now available in territories worldwide is supplemented in most cases by a slew of local providers. In Brazil, local provider Globoplay expanded rapidly in 2020 and now has more than 20mn subscribers, at a highly affordable cost of about US$7 per month. India’s subscription OTT providers span a vast range of price points, from US$4 a year to US$120 a year. Many regional, local language–based players are gaining market share, including the South Indian platform Aha, which offers Telugu-language content for as little as a US$6 annual subscription and has grown rapidly since its launch in March 2020.

The full text of this special report is available on the PricewaterhouseCoopers website at the link below